Ecommerce store

Ecommerce built to grow your business

Control everything from a single platform with centralized inventory, order management and pricing. Lightspeed helps you scale your business anywhere, to anyone.

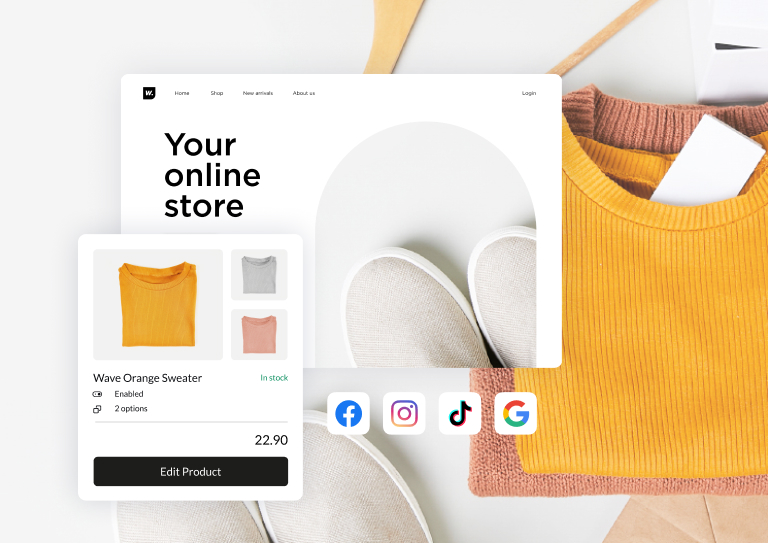

Sell everywhere online.

Your own website.

Build a new ecommerce website or connect to an existing one.

Social media.

Sell across platforms like Facebook, Instagram and TikTok.

Online marketplaces.

Leverage the power of Amazon, eBay, Walmart and Google Shopping.

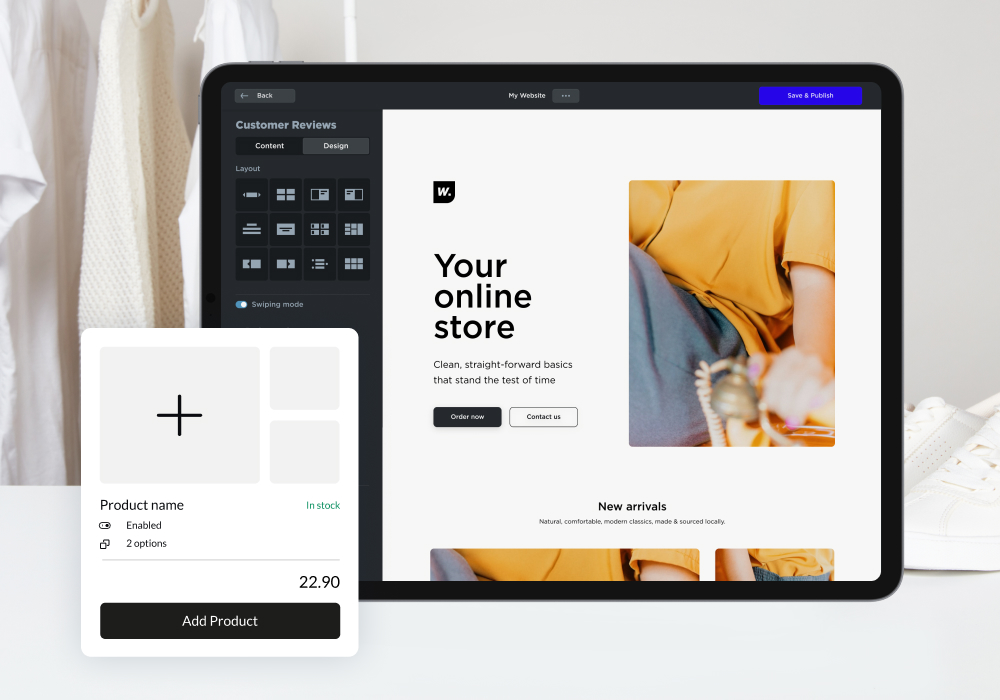

Design a website that grows with you—no coding required.

Make a first impression they'll never forget. Create a storefront that prioritizes speed and simplicity.

- Set up your online store quickly with 30 easy-to-use professional themes to showcase your brand

- Build an ecommerce website from scratch with our simple-to-use website builder

- Already have a website? Instantly connect Lightspeed eCom to WordPress, Wix, Weebly and more

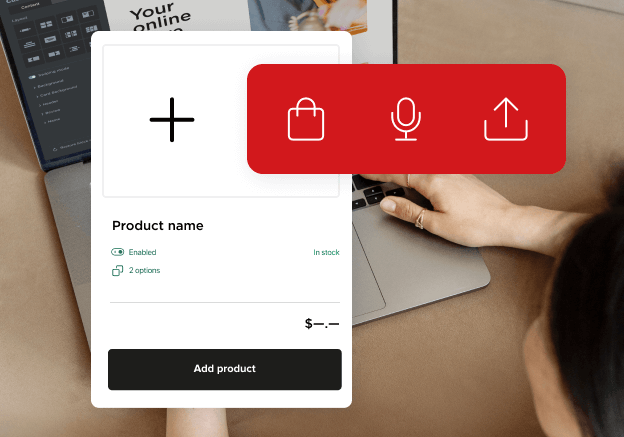

Diversify your business to sell more.

Sell anything you want with Lightspeed eCom. Present a diverse range of offerings to your customers from one platform.

- Market and sell physical goods across sales channels

- Expand your product line with digital goods like ebooks and video content

- Offer subscriptions to lock in customers and generate recurring revenue

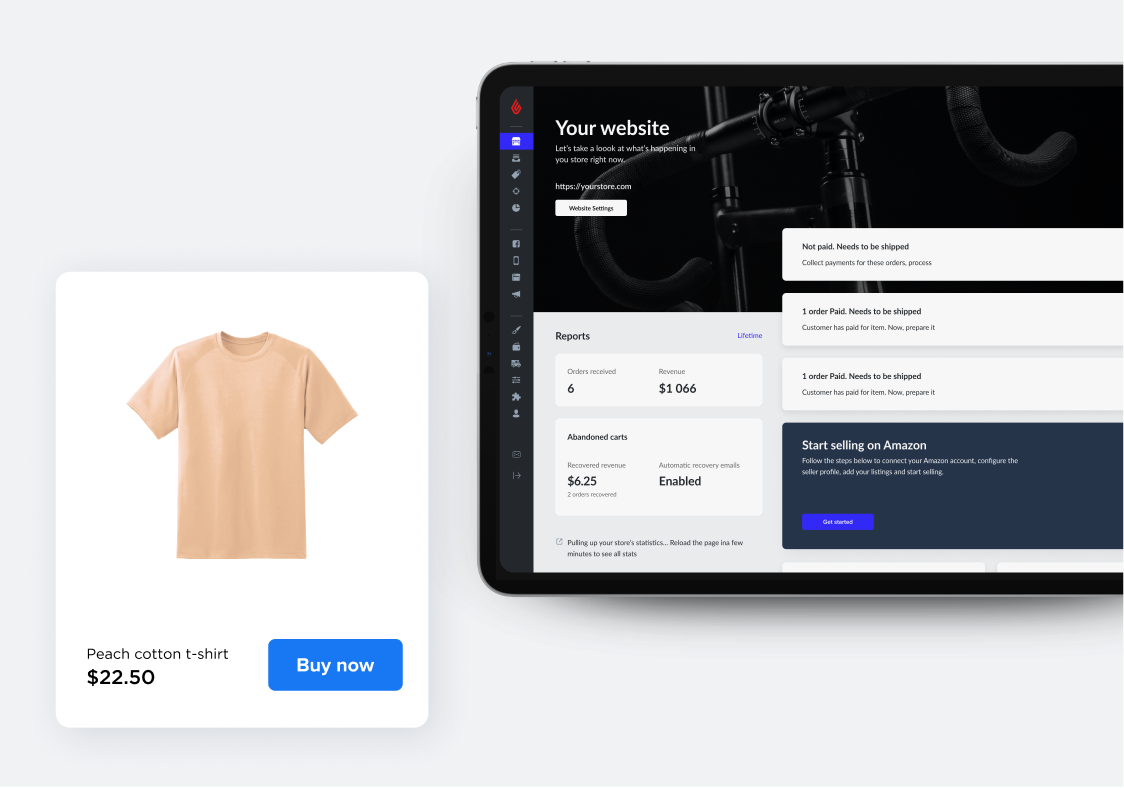

Manage all your sales channels in one place.

Keep your inventory synced across channels and reduce the chance to oversell your stock. Lightspeed's stock management tools let you instantly manage products and inventory across all your channels.

- Import products from your POS system to your ecommerce store in a single click

- Easily track stock levels with a synchronized inventory system

- Connect product catalogs to instantly edit product details across channels

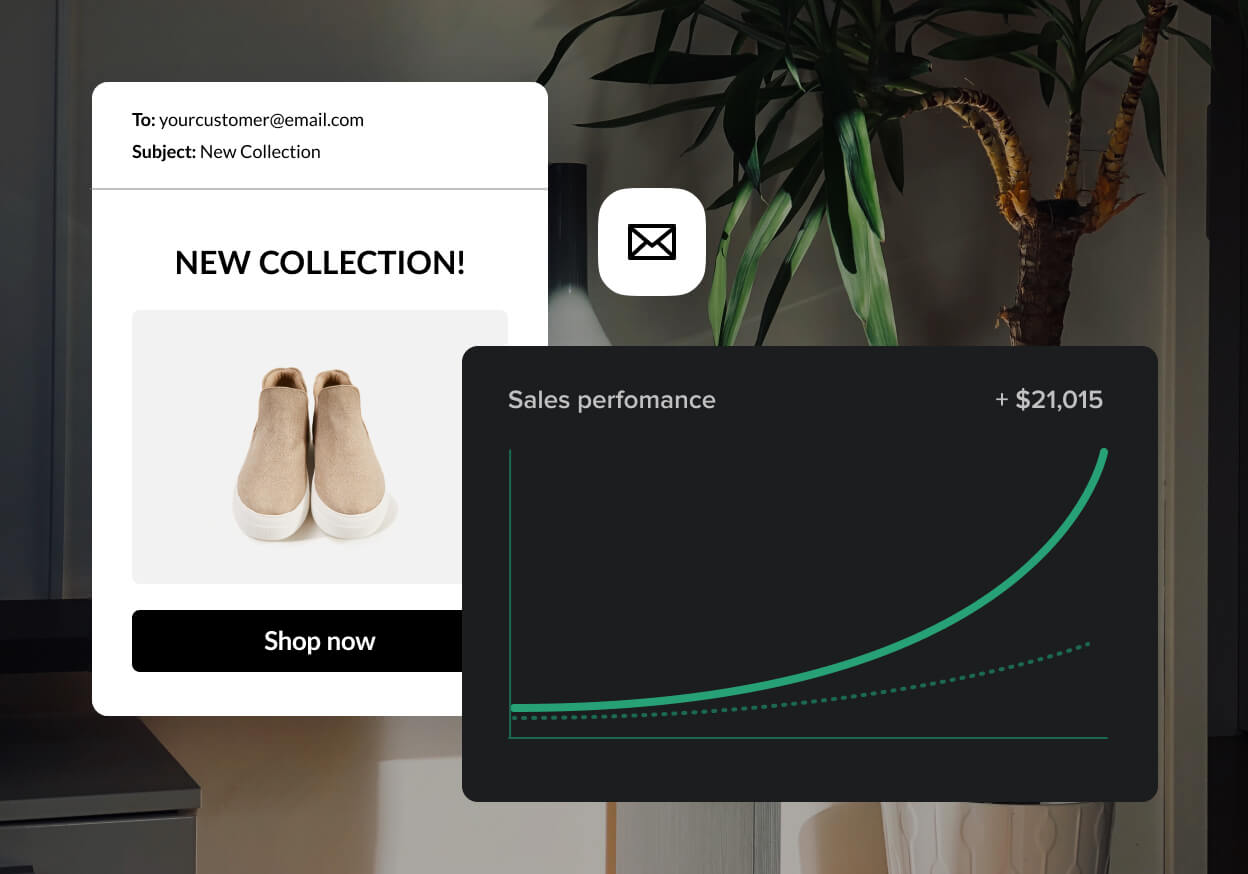

Promote your business online with tools to help you grow faster.

Master online marketing with simple automated tools and connections to some of the biggest advertising platforms on the internet—all from your Lightspeed dashboard.

- Advertise on Facebook and Google with automated product ads and advanced targeting

- Drive more traffic to your store with built-in SEO tools

- Boost conversion rates and recover lost sales with automated abandoned cart emails

Deliver convenience to your customers.

Give your customers the ability to move between an online and in-store shopping experience

- Cater to every kind of customer with integrated shipping and local pickup options

- Offer hands-on service with scheduled local delivery

- Take payment online or curbside for a flexible omnichannel shopping experience

Get the kind of support you've always wanted.

One-on-one onboarding. Webinars, demos and videos. Unlimited 24/7 support. All totally free.